2011 - ZÄHRES - Contingent Convertibles - Bank Bonds Take On A New Look | PDF | Convertible Bond | Bonds (Finance)

Cost of equity vs. CoCo yield diagram. Note: CoCo refers to Contingent... | Download Scientific Diagram

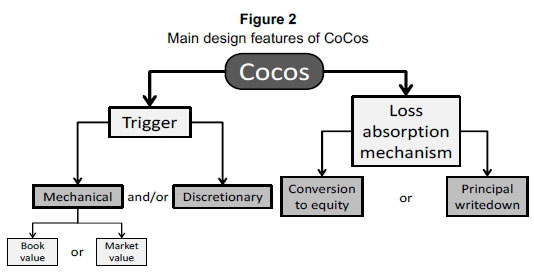

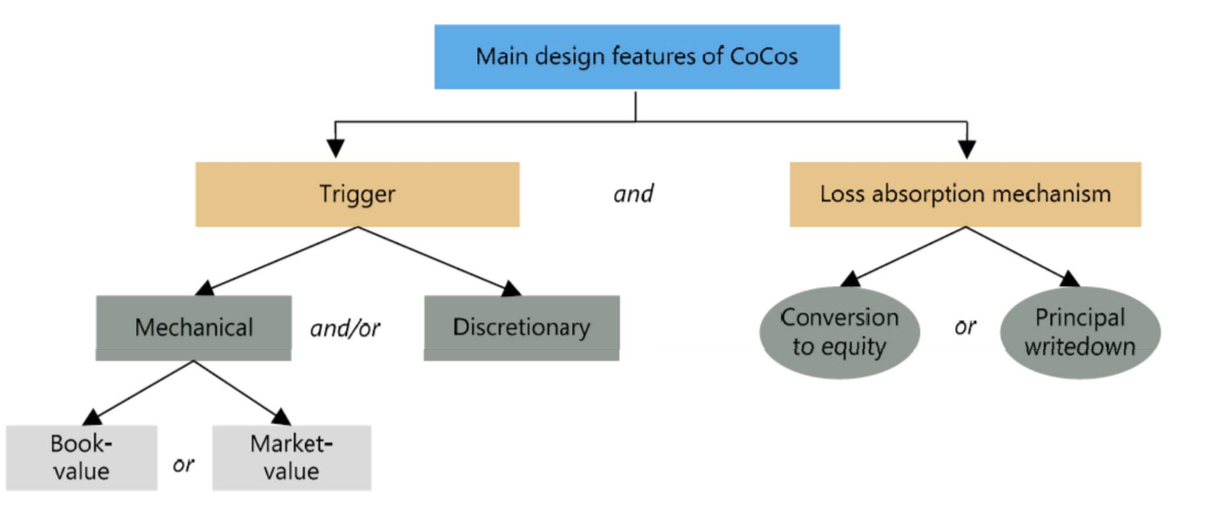

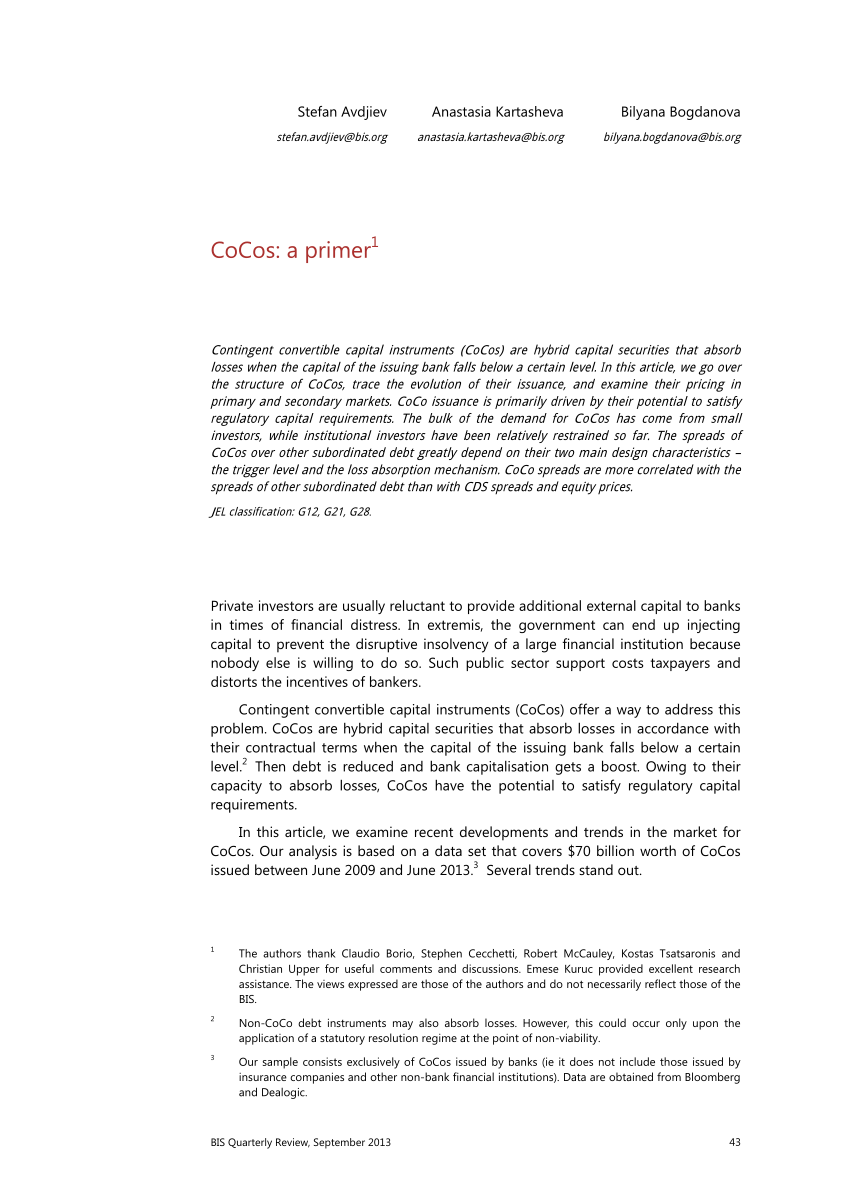

CCN's: What is the rationale behind contingent capital and other hybrid debt instruments? Although "untested" the basics and how they work are covered

Chapter 8: Contingent Capital: Economic Rationale and Design Features in: Building a More Resilient Financial Sector

Chapter 8: Contingent Capital: Economic Rationale and Design Features in: Building a More Resilient Financial Sector

DTC Alert! Corporate Actions Service Updates, Service Updates: USD-Denominated Perpetual Tier 1 Capital Notes of Credit Suisse Group AG. These Credit Suisse's $17 billion in Contingent Convertible Capital Instruments (CoCo) bonds going

Chapter 8: Contingent Capital: Economic Rationale and Design Features in: Building a More Resilient Financial Sector